CNC Prototype Machining: Rapid Prototyping Solutions

Did you know over 40% of product engineering teams slash release schedules by 50% using faster prototype workflows that reflect production?

UYEE Prototype offers a United States–focused capability that speeds design validation with immediate price quoting, auto DfM checks, and shipment tracking. Buyers can get components with an typical lead time down to two days, so teams check form/fit/function before tooling for titanium machining.

The offering includes multi-axis CNC milling and high-precision turning plus sheet metal, SLA 3D printing, and rapid injection molding. Post-processing and finishing arrive integrated, so components arrive ready to test or investor demos.

This process minimizes friction from model upload to finished parts. Wide material choices and manufacturing-relevant quality enable engineers to run reliable mechanical tests while holding schedules and costs predictable.

- UYEE Prototype caters to U.S. customers with fast, manufacturing-like prototyping solutions.

- Instant quotes and automatic DfM accelerate go/no-go choices.

- Common turnaround can be as short as two days for most orders.

- Intricate designs handled through 3–5 axis milling and precision turning.

- >>Integrated post-processing delivers parts ready for demo or testing.

Precision Prototype CNC Machining Services by UYEE Prototype

A responsive team and turnkey workflow makes UYEE Prototype a reliable partner for accurate prototype builds.

UYEE Prototype provides a clear, end-to-end services path from CAD upload to finished parts. The system allows Upload + Analyze for on-the-spot quotes, Pay & Manufacture with secure checkout, and Receive + Review via online tracking.

The experienced team guides DfM, material selection, tolerance planning, and finishing plans. Advanced CNC machines and process controls deliver consistent accuracy so trial builds meet both performance and appearance targets.

Engineering teams gain integrated engineering feedback, scheduling, quality checks, and logistics in one streamlined workflow. Daily factory updates and active schedule control prioritize on-time delivery.

- Single-vendor delivery: single source for quoting, production, and delivery.

- Reliable repeatability: documented checkpoints and SOPs drive consistent results.

- Flexible scaling: from one-off POC parts to multi-piece batches for system tests.

Prototype CNC Machining

Quick, production-relevant machined parts remove weeks from R&D plans and reveal design risks early.

CNC prototypes accelerate iteration by avoiding extended tooling waits. Engineers can order low quantities and verify form, fit, and function in a few days instead of months. This compresses schedules and minimizes downstream surprises before full manufacturing.

- Faster iteration: bypass tooling waits and confirm engineering decisions earlier.

- Mechanical testing: machined parts offer tight tolerances and stable material properties for stress and thermal tests.

- Additive vs machined: additive is fast for concept models but can show anisotropy or lower strength in rigorous tests.

- Injection trade-offs: injection and molded runs make sense at volume, but tooling cost often penalizes early stages.

- Best fit: high-precision fit checks, assemblies needing exact feature relationships, and repeatable A/B comparisons.

UYEE Prototype advises on the right approach for each stage, balancing time, budget, and fidelity to reduce production risk and advance key milestones.

CNC Capabilities Optimized for Quick-Turn Prototypes

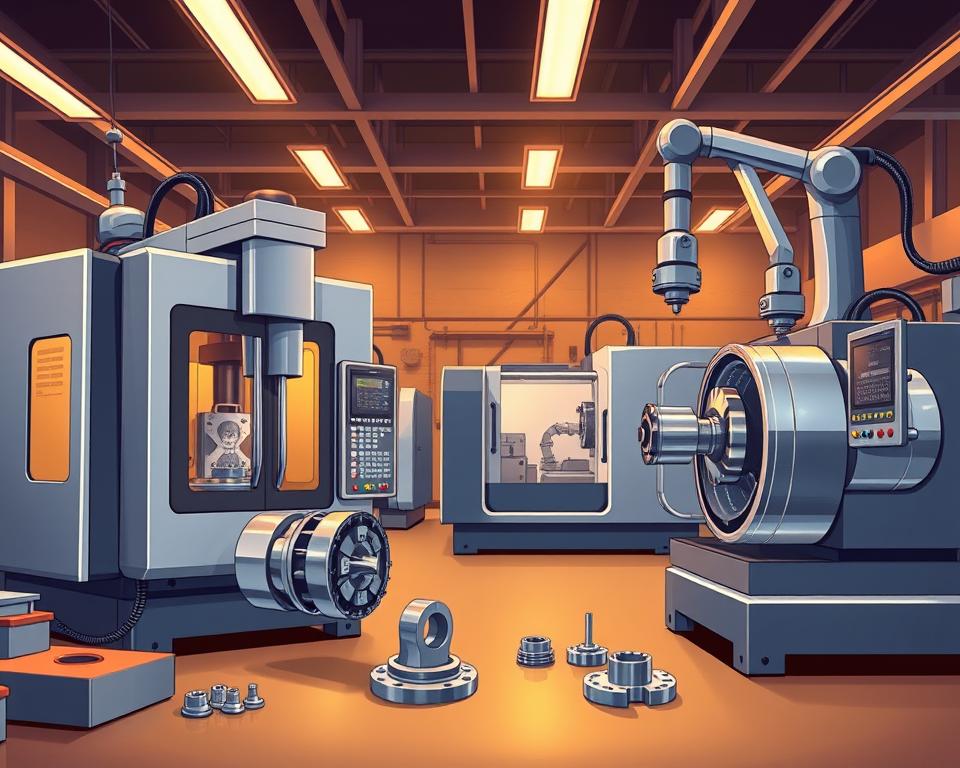

Advanced milling centers and precision turning cells let teams turn complex designs into testable parts at speed.

3-, 4-, and full 5-axis milling for intricate shapes

UYEE runs 3-, 4-, and full 5-axis milling centers that support undercuts, compound angles, and sculpted surfaces for enclosures and mechanisms.

Multi-axis milling reduces setups and preserves feature relationships aligned with the original datum strategy.

Precision turning augments milling for concentric features, thread forms, and bores used in shafts, bushings, and fittings.

Deburring, edge-breaking, and secondary finishing ensure parts are safe to handle and ready for tests.

Tight tolerances and surface accuracy for functional testing

Toolpath strategies and refined cutting parameters trade off speed with dimensional accuracy.

Machine selection and advanced medical device prototyping fixturing increase repeatability across multiple units so test data stays reliable.

UYEE aligns tolerances to the test objective, prioritizing the features that control function and assembly performance.

| Capability | Benefit | When to use |

|---|---|---|

| 3-axis | Fast roughing and simple parts | Basic enclosures |

| 4-/5-axis | Complex surfacing | Complex enclosures, internal features |

| Turning | Concentric accuracy for shafts | Shafts, bushings, threaded components |

From CAD to Part: Our Streamlined Process

A cohesive, end-to-end workflow turns your CAD into ready-to-test parts while minimizing wait time and rework. UYEE Prototype handles every step—quote, DfM, build, and delivery—so your project stays on schedule.

Upload and analyze

Upload a CAD file and obtain an instant quote plus manufacturability highlights. The system highlights tool access, thin walls, and tolerance risks so designers can address issues pre-build.

Pay and manufacture

Secure checkout confirms payment and locks an immediate schedule. Many orders move into production quickly, with average lead time as fast as two days for common prototype builds.

Receive and review

Online tracking provides build status, shipping estimates, and inspection reports. Teams centralize quotes, drawings, and notes in one place to speed internal approvals and keep stakeholders aligned.

- One workflow for single or multi-variant runs makes comparison testing efficient.

- Automated DfM cuts rework by catching common issues early.

- Live status improve visibility and enhance project predictability.

| Step | What happens | Benefit |

|---|---|---|

| Upload & Analyze | Instant pricing and automated DfM report | Quicker iteration, reduced rework |

| Pay + Manufacture | Secure checkout and immediate scheduling | Short lead times; average 2 days for many orders |

| Receive + Review | Online tracking, documentation, team sharing | Predictable delivery and audit trail |

Materials for Prototyping That Mirror Production

A materials strategy that aligns with production grades helps teams trust test results and speeds progress.

UYEE procures a wide portfolio of metals and engineering plastics so parts track with final production. That alignment supports reliable mechanical and thermal evaluations.

Metals for strength, corrosion, and heat

Available metals include Aluminum 6061/7075/5052 for lightweight structures, stainless 304/316/316L for corrosion resistance, brass C360, copper C110, titanium Gr5, mild and alloy steels, and a range of hardened tool steels and spring steel for high-load uses.

Plastics for impact, clarity, and high temp

Plastics offered include ABS (and FR), PC, Nylon 6/12, POM, PP, PE, PMMA, PTFE, PEEK, PVC, FR4, and TPU. Choices span impact resistance, transparency, chemical stability, and heat deflection.

How material choice affects tests

Matching prototype CNC machining material grade boosts tolerance holding and surface quality, so fit and finish results reflect production reality. Tough alloys or filled polymers may affect achievable cosmetic finish and machining marks.

| Category | Example Grades | When to Use |

|---|---|---|

| Light metal | Al 6061 / 7075 | Structural, lightweight parts |

| Corrosion resistance | SS 304 / 316L | Moisture-prone areas |

| High-performance | Titanium Gr5 / Tool steels | Severe duty |

| Engineering plastics | PC, PEEK, Nylon | Impact, clarity, high temp |

UYEE works with you to optimize machinability, cost, lead time, and downstream finishing to select the best material for representative results.

Surface Finishes and Aesthetics for Production-Like Prototypes

Selecting an appropriate finish turns raw metal into parts that look and perform like production.

Baseline finishes offer a fast route to functional testing or a polished demo. Standard as-milled preserves accuracy and speed. Bead blast provides a consistent matte, and Brushed finishes add directional grain for a refined, functional look.

Anodizing boosts hardness and corrosion resistance and can be dyed for color. Black oxide reduces reflectivity and provides mild protection. Electrically conductive oxidation preserves electrical continuity where grounding or EMI paths are needed.

Presentation painting and color

Spray painting offers matte and gloss options plus Pantone matching for brand fidelity. Painted parts can approximate final color and feel for stakeholder reviews and investor demos.

- Finish choice affects perceived quality and helps simulate production cosmetics.

- Achievable surface quality is influenced by base metal, toolpath, and handling sensitivity.

- UYEE Prototype supports a range of finishing paths—from rugged textures for test articles to show-ready coatings for demos.

| Finish | Benefit | When to Use |

|---|---|---|

| As-milled | Fast, accurate | Functional tests |

| Bead blast / Brushed | Matte uniformity / directional aesthetics | Aesthetic surfaces |

| Anodize / Black oxide | Corrosion resistance / low shine | Customer-facing metal |

Quality Assurance That Meets Your Requirements

Documented QA/QC systems lock in traceability and results so teams can rely on test data and schedules.

ISO-aligned controls, first article compliance, CoC and material traceability

ISO-aligned procedures guide incoming material verification, in-process inspections, and final acceptance to meet stated requirements. Documented controls limit variance and support repeatable outcomes across batches.

First Article Inspection (FAI) services helps establish a dimensional baseline for critical builds before additional units proceed. Measurement strategies include CMM reports, calibrated gauges, and targeted feature checks to preserve precision and accuracy where it is critical.

Certificates of Conformance and material traceability are provided on request to serve regulated manufacturing and procurement needs. Material and process trace logs record origin, heat numbers, and processing steps for audit readiness.

- Quality plans are tailored to part function and risk, balancing rigor and lead time.

- Documented processes increase consistency and reduce variability in test outcomes.

- Predictable logistics and monitored deliveries maintain schedule adherence.

Intellectual Property Protection You Can Count On

Security for sensitive designs begins at onboarding and extends through every production step.

UYEE implements contractual safeguards and NDAs to hold CAD files, drawings, and specs confidential. Agreements set handling, retention, and permitted use so your development work remains protected.

Controlled data handling methods lower risk. Role-based access, audit logs, and file traceability record who accessed or edited designs during quoting, manufacturing, and shipping.

Strict onboarding and data controls

Vendors and staff complete strict onboarding with contractual obligations and training on confidentiality. Background checks and defined access limits align teams to protection methods.

- Secure file transfer and encrypted storage for additive-ready and machining-ready files.

- Traceable change history and signed NDAs for all external partners.

- Documented processes that govern quoting, production, inspection, and logistics.

| Control | How it protects IP | When it applies |

|---|---|---|

| NDAs & contracts | Define legal obligations and remedies | Project start to finish |

| Access controls | Limit file access and log activity | Quoting, CAM prep, manufacturing |

| Encrypted transfer & storage | Protect files in transit and at rest | Uploading, sharing, archival |

| Trained team | Ensures consistent handling across projects | Every phase |

Industry Applications: Validated Across Demanding Use Cases

High-stakes programs in medicine, aerospace, and defense need accurate parts for valid test results.

Medical and dental teams employ machined parts for orthotics, safe enclosures, and research fixtures that require tight tolerances.

Precise metal selection and controlled finishes mitigate risk in clinical tests and regulatory checks.

Automotive

Automotive applications include fit/function interiors, brackets, and under-hood components exposed to heat and vibration.

Rapid cycles enable assembly validation and service life before committing to production tooling.

Aerospace and aviation

Aerospace demands accurate manifolds, bushings, and airfoil-related parts where small deviations affect airflow and safety.

Inspection plans center on critical dimensions and material traceability for flight-worthiness evaluation.

Defense and industrial

Defense and industrial customers need durable communication components, tooling, and machine interfaces that hold up under stress.

UYEE Prototype adapts finish and inspection scope to meet rugged operational demands and procurement standards.

Consumer electronics and robotics

Consumer electronics and robotics need fine features, cosmetic surfaces, and precise mechanisms for smooth assembly and user experience.

Short runs of CNC machined parts speed design validation and help teams refine production intent before scaling.

- Industry experience anticipates risk and guides pragmatic test plans.

- Material, finish, and inspection are tuned to each sector’s operating and compliance needs.

- UYEE Prototype serves medical, automotive, aerospace, defense/industrial, consumer electronics, and robotics customers across the U.S.

| Industry | Typical applications | Key considerations |

|---|---|---|

| Medical & Dental | Orthotics, enclosures, fixtures | Tight tolerances, biocompatible finishes |

| Automotive | Brackets, fit checks, under-hood parts | Heat, vibration, material durability |

| Aerospace | Manifolds, bushings, flight components | Dimensional accuracy, traceability |

| Consumer & Robotics | Housings, precision mechanisms | Cosmetic finish, fine features |

Design for Machining: Prototyping Guidelines

A DfM-first approach focuses on tool access, rigid features, and tolerances that meet test goals.

Automated DfM feedback at upload identifies tool access, wall thickness, and other risks so you can refine the 3D model pre-build. UYEE aligns multi-axis selection to the geometry rather than forcing a 3-axis setup to approximate a 5-axis method.

Geometry, tool access, and feature sizing for 3–5 axis

Keep walls appropriately thick and features within cutter reach. Minimum wall thickness varies by material, but designing wider webs cuts chatter and tool deflection.

Use radiused fillets at internal corners to allow proper cutter engagement. Deep, small pockets should be designed with ramped entries or multiple setups in mind.

Tolerance planning for appearance vs functional parts

Separate cosmetic and functional tolerances upfront. Tight form tolerances belong on critical interfaces. Looser cosmetic limits reduce cycle time and reduce cost.

Define datum schemes and tolerance stacks for assemblies and kinematic mechanisms. Document measurement plans for critical features so acceptance criteria are clear before the first run.

- Set minimum wall thickness, feature depths, and fillets to improve tool access and stability.

- Use 5-axis when feature relationships or undercuts need single-setup accuracy; choose simple fixturing when speed matters.

- Specify best practices for threads, countersinks, and small holes to limit deflection and deliver repeatable quality.

- Early DfM reviews cut redesign and accelerate prototyping iterations.

| Focus | Design Rule | Benefit |

|---|---|---|

| Wall & Fillet | Wider webs, radiused corners | Reduced deflection, better surface finish |

| Setups | Prefer 5-axis for complex relations | Fewer fixtures, preserved geometry |

| Tolerances | Functional vs cosmetic | Cost control, faster cycles |

Speed to Market: Lead Times and Low-Volume Runs

Rapid builds tighten timelines so engineers can advance from idea to test faster.

UYEE offers rapid prototyping with average lead times as fast as two days. Rapid scheduling and standardized setups cut lead time for urgent EVT and DVT builds.

Low-volume runs bridge to pilot production and enable assembly testing or limited market trials. Short-run parts keep the same inspection, documentation, and traceability as one-off parts.

Teams can reorder or revise parts quickly as development learning builds. Tactical use of CNC allows deferring expensive tooling until the design matures, minimizing sunk cost.

Consistent delivery cadence aligns test plans, firmware updates, and supplier readiness so programs stay on schedule.

| Attribute | Typical Range | When to Use |

|---|---|---|

| Lead time | 1–5 days (avg 2 days) | Urgent engineering builds |

| Run size | 1–200 units | Validation, pilot trials |

| Quality & docs | FAI, CoC, inspection reports | Regulated tests, production handoff |

| Flexibility | Fast reorders, design revisions | Iteration-driven development |

CNC vs Injection Molding and 3D Printing for Prototypes

Picking the right method can save weeks and budget when you move from concept to test parts.

Low quantities force a practical decision: avoid long waits or invest in tooling for lower unit cost. For many low-quantity runs, machined parts beat molds on schedule and upfront cost. Printing is fastest for concept visuals and complex internal lattices, but may not match mechanical performance.

Cost, time, and fidelity trade-offs at low quantities

Injection molding demands tooling that can take months and thousands in cost. That makes it uneconomical for small lots.

Machined parts avoid tooling fees and often deliver better dimensional control and stronger bulk properties than many printed parts. Chips from metal removal are reclaimed to minimize scrap.

- Time: printing for hours to days; machining for days; injection may take weeks to months.

- Cost: low unit counts favor machining or printing; molding only pays off at volume.

- Fidelity: machining delivers consistent tolerances and surface finish; printing can show layer anisotropy and layer artifacts.

When to bridge from CNC prototypes to molding

Plan a bridge to injection when the design is stable, tolerances are locked, and material choice is locked. Use machined parts to prove fit, function, and assembly before tooling up.

Early DfM learnings from machined runs cut mold changes and improve first-off success. Right-size raw stock, nest efficiently, and recycle chips to improve sustainability during the transition.

| Attribute | Best for | Notes |

|---|---|---|

| Printing | Ultra-fast concepts, complex lattices | Low strength; good for visual and some functional tests |

| Machining | Small lots, tight tolerances, mechanical tests | Avoids tooling; recyclability reduces waste |

| Injection | High-volume production | High upfront tooling; lowest unit cost at scale |

Beyond CNC: Additional On-Demand Manufacturing

Modern development benefits from a suite of on-demand methods that match each milestone.

UYEE Prototype augments its offering with sheet metal, high-accuracy 3D printing, and rapid injection molding to cover the full range of development needs.

Sheet metal fabrication uses laser cutting and bending for fast flat-pattern iterations. It is ideal for enclosures and brackets with formed features that are difficult or costly to mill.

3D printing and SLA

SLA printing delivers smooth surfaces and fine detail for concept models and complex internal geometries. It enables speedy visual checks and fit trials before moving to harder materials.

Rapid injection molding

Rapid tooling, family molds, and multi-cavity options enable bridging to higher volumes once designs are stable. Overmolding can add soft-touch or bonded layers in the same run.

Multi-process programs often combine CNC parts with printed components or sheet metal to speed subsystem integration. Material and process selection focus on validation goals, schedule, and budget.

- Sheet metal: fast iterations for formed parts and brackets.

- SLA printing: high-accuracy surfaces and internal detail.

- Rapid molding: cost-effective bridge when volumes justify tooling.

| Method | Best use | Key benefit |

|---|---|---|

| Sheet metal | Enclosures, brackets | Fast flat-pattern changes |

| SLA printing | Concept and internal features | Smooth finish, fine detail |

| Rapid molding | Bridge volumes | Production-like parts, repeatability |

Get an Immediate Quote and Begin Now

Upload your design and receive immediate pricing plus actionable DfM feedback to cut costly revisions.

Upload files for guaranteed pricing and DfM insights

Send CAD files and receive an instant, guaranteed quote with automated DfM that flags tool access, thin walls, and tolerance risks.

The platform secures pricing and schedule so your project can move into production planning without delay.

Work with our skilled team for prototypes that match production intent

Our team collaborates on tolerances, finishes, and materials to align builds with final intent.

UYEE handles processes from scheduling through inspection and shipment, reducing vendor overhead and keeping every step transparent.

- Upload CAD for guaranteed pricing and fast DfM feedback to reduce risk.

- Collaborative reviews align tolerances and finishes to the product goal.

- Secure payments, online tracking, and transparent updates maintain visibility through delivery.

| What | Benefit | When |

|---|---|---|

| Instant quote | Guaranteed pricing | Start project fast |

| DfM report | Fewer revisions | Design validation |

| Order tracking | Full visibility | On-time delivery |

Start today to shorten lead times and get production-intent, CNC machining work, including precision-machined and machined parts that support stakeholder reviews and performance tests.

To Summarize

Bridge development gaps by using a single supplier that marries multi-axis capabilities with fast lead times and documented quality.

UYEE Prototype’s ecosystem of CNC equipment, materials, and finishes supports rapid prototyping with production-grade fidelity. Teams get access to multi-axis milling, turning, and a broad material set to match test objectives.

Choosing machining for functional work provides tight tolerances, predictable material performance, and repeatable results across units. That consistency improves test confidence and speeds the move to production.

The end-to-end workflow—from instant quote and automated DfM to Pay & Manufacture and tracked shipment—keeps schedule risk low. Robust quality artifacts like FAI, CoC, and traceability preserve measurement discipline and surface outcomes.

Options across CNC, printing, and injection molding let you pick the right method at each stage. Start your next project now to get instant pricing, expert guidance, and reliable delivery that reduces time-to-market.